TECHNICAL ANALYSIS

Introduction to Technical Analysis

Technical Analysis, is a method used for analysis and

forecasting the direction(rise or fall) of prices through the study of recorded

price data, often in form of charts.

This price data for the currencies is provided by your

broker through the trading platform.

The Forex charts contain the candlesticks.

You can add indicators and other objects in the charts to

help you to analyse the Forex price action.

For Technical Analysis, I will take you through the six main

pillars of this type of analysis.

These are:

- Trend.

- Support

levels.

- Resistance

levels.

- Chart

patterns.

- Candlestick

shapes and patterns.

- Indicators.

Trend

A trend is a tendency for prices to move in a particular

direction. That is either up or down.

The two types of trends are:

- Uptrend.

- Downtrend

Let’s start with an uptrend

Uptrend

In this example, you are looking at the US Dollar, Swiss

Franc pair.

The US Dollar is the Base currency and its price is rising

against the Swiss Franc.

Here, we say that the US Dollar is in an uptrend.

We should only think of buying, not selling in an uptrend.

So, if you see that a currency pair is in an uptrend, should

you go and buy it right away?

Well, no!

There will be an article where I will guide you on how to

enter trades.

Let’s now go to a downtrend.

Downtrend

For a downtrend, the price of the Base currency is consistently

going down.

In this example, you can see that the price of the Euro is

falling against the US Dollar.

For such a case, you should only think of selling, not

buying.

Consolidations in the Forex Charts

But wait, do currency pairs trend all the time?

The simple answer is no!

In this example, you can see that the pair is not trending.

As traders, we say that that currency pair is consolidating

within a range.

In this case, do you buy or sell.

Well, to trade a pair that is consolidating, you need to

understand the concept of support and resistance.

Support levels in the Forex Charts

Support levels, are also known as demand zones.

A support level, is a price level in the forex chart where

there are more buyers than sellers.

You recognize a demand zone, if the price of the base currency rises more than

one time whenever it gets to that price level.

In the example above, you can see that the price of the US

Dollar keeps rising repeatedly whenever it gets to that support level.

In that support level, you should think of buying because

you expect the price to rise.

Resistance levels in the Forex Charts

Resistance levels are also known as supply zones.

A resistance level is a price level in the forex chart,

where there are more sellers than buyers.

You recognize a supply zone, if the price of the base currency falls more than

one time whenever it gets to that price level.

In the example above, you can see that the price of the US

Dollar keeps falling repeatedly whenever it gets to that resistance level.

In that resistance level, you should think of selling

because you expect the price to fall.

Chart Patterns

A Chart Pattern is a shape formed within the price chart by

many candlesticks that help to suggest what prices might do next.

Some chart patterns are important because when they occur,

prices tend to behave in a particular manner.

There two major categories of Chart Patterns.

These are:

- Trend continuation patterns.

We will look at the major two.

2.

Trend reversal patterns.

We will look at the major four.

Trend Continuation Chart Patterns

Bullish Rectangle

The first trend continuation pattern is a bullish rectangle.

It shows the continuation of an uptrend.

The bullish rectangle is an area of consolidation during an

uptrend, and the uptrend continues.

You can see that in this Swiss Franc, Japanese Yen chart.

Bearish Rectangle

The second trend continuation pattern is a bearish

rectangle.

It shows the continuation of a downtrend.

The bearish rectangle is an area of consolidation before the

continuation of the downtrend.

Trend Reversal Chart Patterns

Double Bottom Chart Pattern

The first trend reversal chart pattern is the double bottom

chart pattern.

It shows the reversal of a downtrend to form an uptrend due

to a very strong support level.

Double Top Chart Pattern

The second trend reversal chart pattern is the double top

chart pattern.

It shows the reversal of an uptrend to form a downtrend due

to a very strong resistance level.

Head and Shoulders Chart Pattern

The third trend reversal chart pattern is the head and

shoulders chart pattern.

It shows the reversal of an uptrend to form a downtrend due

to a very strong resistance level.

Inverse Head and Shoulders Chart Pattern

The fourth trend reversal chart pattern is the inverse head

and shoulders chart pattern.

It shows the reversal of a downtrend to form an uptrend due

to a very strong support level.

The important candlestick shapes and patterns

Candlestick shapes and patterns can be used to predict price

movement, but you should not use them alone.

Candlestick Shapes and Patterns that give a buying signal

The candlestick pattern on the left is the bullish engulfing

pattern.

It shows increased buying pressure due to the large green

bullish candle, compared to the small red bearish candle.

The candlestick shape on the right is the hammer candle,

also known as the bullish pin bar.

It shows increased buying pressure, because the sellers had

pushed the prices down but the buyers came in later and pushed the price up,

which is shown by the long lower candle-wick.

Candlestick Shapes and Patterns that give a selling signal

The candlestick pattern on the left is the bearish engulfing

pattern.

It shows increased selling pressure due to the large red

bearish candle, compared to the small green bullish candle.

The candlestick shape on the right is the shooting-star

candle, also known as the bearish pin bar.

It shows increased selling pressure, because the buyers had

pushed the prices up but the sellers came in later and pushed the price down,

which is shown by the long upper candle-wick.

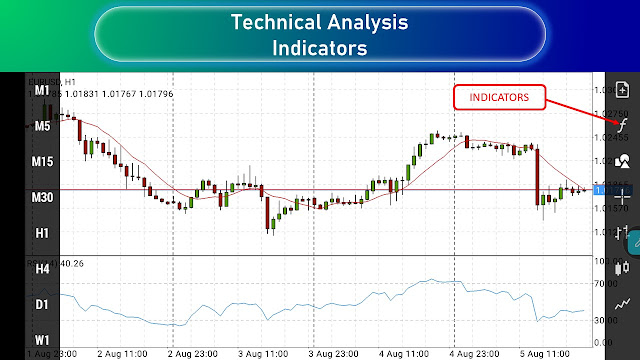

The major Forex Indicators

Indicators help traders in analysis of the Forex

Charts.

They are derived from the prices already shown in the

Forex Charts.

The major

indicators used in Forex Charts are:

- The Moving Average

- The RSI indicator

- The ATR indicator

You don’t have to use all of them, or even any.

Adding an indicator in the Forex

Charts

To add an

indicator in the Forex Charts, tap the f function sign in the Charts Tab

of MetaTrader 4.

The Moving Average Indicator

The first indicator, is the Moving Average.

When adding the Moving Average Indicator, set the period to

be 50, as it will calculate the average closing price of the last 50 candles.

It is the best for spotting trends.

The major function of the moving average indicator is to

help you easily identify trends.

In the USDCAD example above, you can see that the price is

staying above the 50 Moving Average, so this will be considered as an uptrend.

In this EURUSD example below, the price is staying below the

50 Moving Average, so this will be considered as a downtrend.

The RSI Indicator

The second indicator, is the RSI Indicator.

RSI in full, is Relative Strength Index.

The RSI Indicator is an oscillator that shows overbought and

oversold areas in the Forex Chart.

It oscillates from a value of 0 to 100.

If the RSI is above 70, it means that the market is

overbought and if it is below 30, it means that the market is oversold.

If a currency is overbought, it means that its price has

rose quickly within a short time, and the price is likely to go down afterwards.

But you should not sell in an uptrend, simply because the

RSI says that the market is overbought. The same goes for buying in a

downtrend, simply because the RSI says oversold.

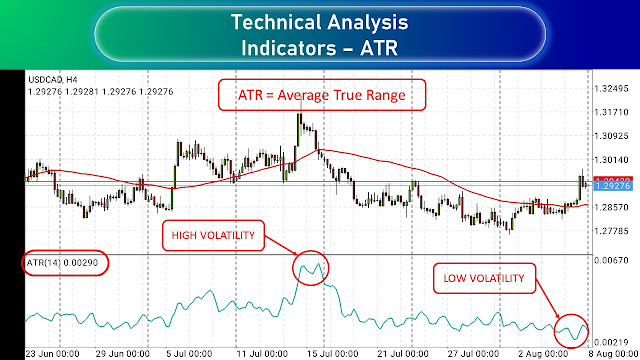

The ATR Indicator

The third indicator, is the ATR Indicator.

ATR in full, is Average True Range.

The ATR Indicator is used to measure the volatility of a

currency pair.

It measures volatility by calculating the movement of pips.

So, the higher the volatility, the higher the reading.

Trading should be done when the volatility is neither too

high, nor too low.

Very high volatility is only good for scalpers.

Also, some currency pairs are generally more volatile than

others.

For example, the British Pound against the Japanese

Yen(GBPJPY) is very volatile. So, I don’t recommend beginners to trade it.

The currency pair that I recommend for beginners is the

EURUSD pair, because it is moderately volatile and the spreads are very low.

But you can still trade other pairs if you spot good trading

opportunities.

No Comments